fremont ca sales tax calculator

This is the total of state county and city sales tax rates. The estimated 2022 sales tax rate for 94538 is.

Math Equation To Calculate Sales Tax

Our income tax calculator calculates your federal state and local taxes based on several key inputs.

. We also know the IRS. This is the total of state county and city sales tax rates. Below 100 means cheaper than the US average.

Our Premium Calculator Includes. Our Premium Calculator Includes. Usually the vendor collects the sales tax from the consumer as the consumer makes.

Additional sales tax is then added on depending on location by local government. Website Contact Us Directions. Fremont California and San Jose California.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required. Multiply the vehicle price before trade-in or incentives by the sales tax fee. The current total local sales tax rate in Fremont CA is 10250.

At Jackson Hewitt we know taxes. Please visit our State of Emergency Tax Relief page for. How much is sales tax in Fremont in Nebraska.

Putting everything together the average. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local. Ad Lookup Sales Tax Rates For Free.

What is the sales tax rate in Fremont California. The base level state sales tax rate in the state of California is 6. The 2018 United States Supreme Court decision in South Dakota v.

2022 Cost of Living Calculator for Taxes. 1788 rows Businesses impacted by recent California fires may qualify for extensions tax relief and more. If youre an online business you can connect TaxJar directly to your shopping cart.

Above 100 means more expensive. 54 rows A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The California sales tax rate is currently.

- Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. Method to calculate Fremont County sales tax in 2021. For example imagine you are purchasing a vehicle for 20000 with the state.

Method to calculate Fremont sales tax in 2022. The December 2020 total local sales tax rate was 9250. Warm Springs Fremont 10250.

The Fremont California sales tax rate of 1025 applies to the following five zip codes. Has impacted many state nexus laws and sales tax collection. The minimum is 725.

- Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. As we all know there are different sales tax rates.

Taxes in Fremont California are 1050 more expensive than Van Buren Arkansas. The minimum combined 2022 sales tax rate for Fremont Valley California is. 100 US Average.

The minimum combined 2022 sales tax rate for Fremont California is 1025. California has a 6 statewide sales tax rate but also has 469 local tax jurisdictions including cities towns counties and special districts that.

Fremont County Wy Sales Tax Rate Sales Taxes By County November 2022

Sales Tax Impact Is Murky For Normal As Rivian Sales Begin Wglt

If You Make 150k Per Year In California What Percent Of That Money Goes To Taxes Quora

Nebraska Sales Tax Rates By City County 2022

Ca Owner Sales Tax Registration License Fees Tesla Motors Club

How To Calculate California Sales Tax 11 Steps With Pictures

Is Shipping In California Taxable Taxjar

Nashville Sales Tax Rate Would Tie Chicago For Nation S Highest Under Mayor Barry Transit Plan

Why Households Need 300 000 To Live A Middle Class Lifestyle

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

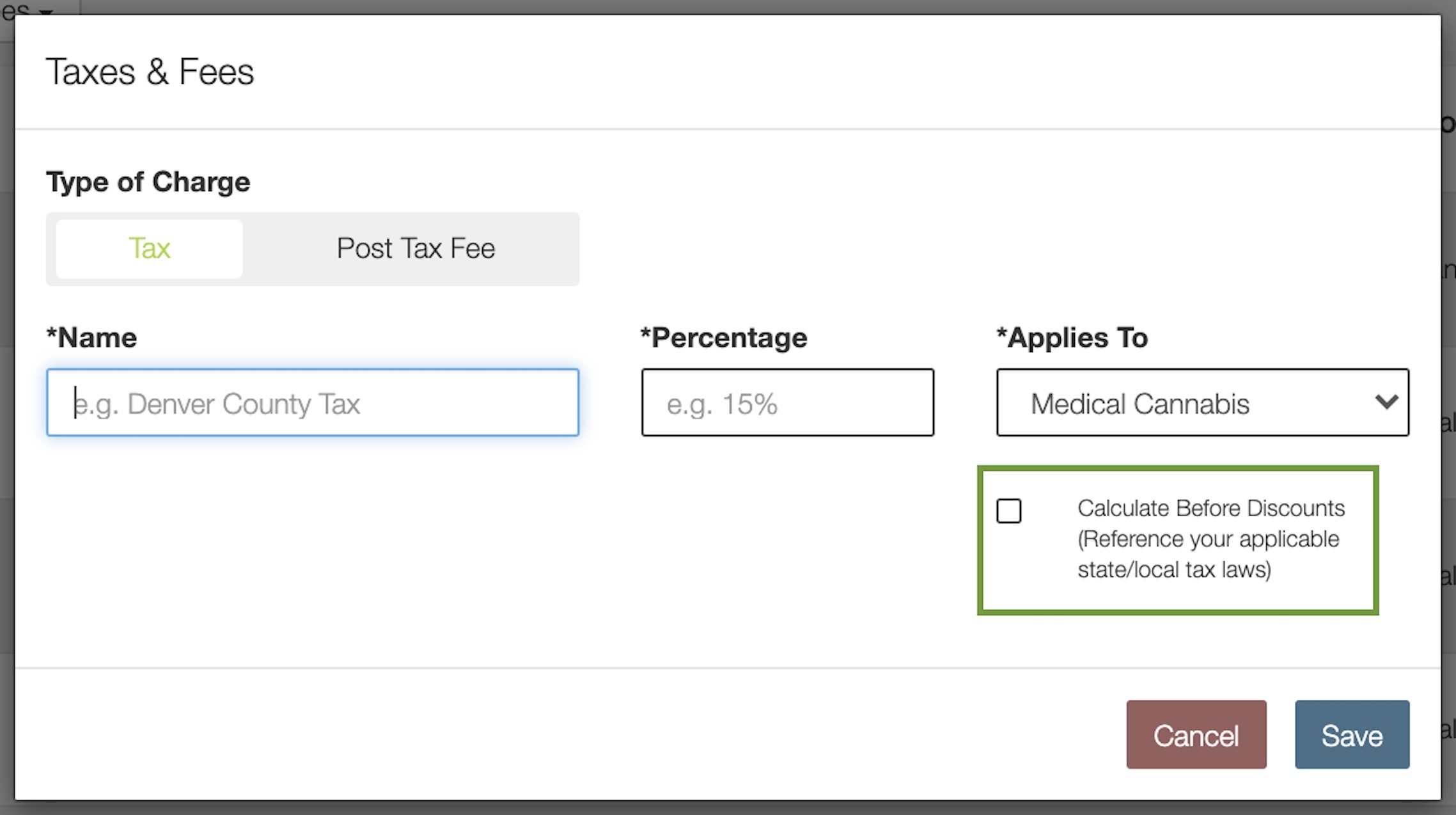

How To Calculate Cannabis Taxes At Your Dispensary

Nebraska Sales Tax Guide For Businesses

San Jose Millennials Pay Some Of The Highest Effective Tax Rates In The Nation Along With San Francisco East Coast Cities Silicon Valley Business Journal

Why Households Need 300 000 To Live A Middle Class Lifestyle

1099 Tax Calculator For Self Employed Workers Independent Contractors Fincent

Taxes Fees Make Up 1 18 Per Gallon Of Gas In California Ktla